January 13, 2014 Honolulu Star-Advertiser Newspaper Front Page Story by Rob Perez

Several years after he stopped making his mortgage payments, Kale Gumapac was evicted from his foreclosed Hawaii island home.

Days before Thanksgiving, sheriff’s deputies escorted a handcuffed Gumapac — he was arrested on a trespassing charge — from the Hawaiian Paradise Park property he had called home for more than a decade.

Gumapac said he stopped making his $3,000-a-month payments about five years ago because his lender couldn’t produce the original note for his loan, raising questions about who actually had title to the property.

After his mortgage subsequently was acquired by another bank but well before he was evicted in November, Gumapac switched strategies and embraced a controversial legal argument that has surfaced in a small but growing number of foreclosure cases over the past several years.

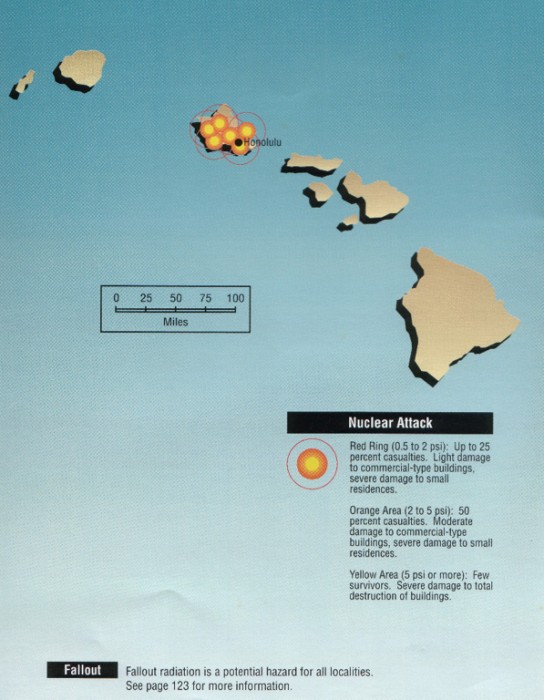

He argued that Hawaii courts are unlawfully constituted, dating from the illegal overthrow of the Hawaiian monarchy in 1893. He also maintained that Hawaii land titles have been defective since the overthrow.

Like dozens of other Hawaii residents, Gumapac made those arguments based on the claim — repeatedly rejected by state and federal judges — that the Hawaiian kingdom still exists and the U.S. is illegally occupying the islands.

Gumapac even has a company that helps homeowners make the same kingdom argument to file defective-title claims.

Many inside and outside the real estate industry scoff at the argument, saying it is preposterous, ignores more than 100 years of history and has been discredited numerous times in the judicial arena.

“Every court that has considered this has found that the argument has no merit whatsoever,” said attorney David Rosen, who represents lenders. “These people are selling a scam.”

Gumapac and other proponents point to the same historical record to justify their position, citing, among other things, an 1893 executive agreement between Queen Liliuokalani and President Grover Cleveland that called for the eventual restoration of the kingdom government. They said the agreement obligated Cleveland’s successors as well.

State and federal judges, however, consistently have rejected the notion that the kingdom still exists or kingdom law still applies in Hawaii. Appellate courts have done the same.

Not even advocates of the kingdom defense can cite a single case in which a homeowner ultimately prevailed.

Yet more homeowners appear to be adopting the legal strategy, according to attorneys and others who deal with such matters.

One recent case involved Office of Hawaiian Affairs Trustee Dan Ahuna, who in a May court filing asked a state judge to dismiss his lender’s foreclosure lawsuit. Ahuna argued that the state court lacked jurisdiction because the kingdom still exists.

In September the court rejected Ahuna’s argument. Since then he and his wife have had their loan modified through the U.S. government’s foreclosure prevention program, according to Ahuna, who said financial difficulties, not personal beliefs, prevented them from making their mortgage payments when the 2008 foreclosure complaint was filed.

“I simply underestimated the scale and complexity of using this particular legal argument to improve my ability to avoid foreclosure,” Ahuna said in a written response to the Honolulu Star-Advertiser, emphasizing that he was speaking as an individual and not as an OHA trustee.

Dexter Kaiama, a Kailua lawyer, says that over the past three years he has taken on more than 150 clients whose underlying defense questions the validity of local courts. The majority of those clients, including Gumapac, were homeowners already in the midst of foreclosure proceedings, according to Kaiama.

Gumapac, whose Big Island company is called Laulima Title Search and Claims, said he continues to get new clients even since his November eviction. Laulima now has about 300 total clients, and Gumapac charges $3,900 for his services, he said.

While the kingdom-still-exists argument has not prevailed in court, some homeowners seem to be benefiting in one significant way: They have stayed in their homes long after they stopped paying their mortgages, thanks largely to the slow pace in which such cases move through a strained judicial system.

Real estate officials say Gumapac’s challenge of the court’s authority likely contributed to the prolonged period he was able to stay in his home after defaulting on the mortgage.

Kaiama said dozens of eviction orders are pending against his clients, and he suspects the legal argument that the orders are unlawful have contributed to delays in enforcing them. A judge presiding over one of Kaiama’s foreclosure cases recently asked the attorney to provide more information on the jurisdiction issue.

Gumapac said he stopped paying his mortgage when his lender was unable to provide the original copy of his loan note and couldn’t answer certain questions about the property’s title. At the time, the nation was in the midst of a mortgage crisis that included a dramatic rise in foreclosures and growing questions about unfair and predatory practices by lenders.

“I wasn’t trying to run away from my obligation to pay that debt,” Gumapac said. “I was following my contract.”

After Deutsche Bank acquired Gumapac’s mortgage, he learned of research that called into question the validity of all Hawaii land titles since the 1893 overthrow. Proponents of that position say that titles filed since then are invalid because they were not processed under kingdom law. Gumapac became a believer.

Armed with such research, he asked his lender to file a title insurance claim, which he said he believed the bank was obligated to do under terms of his mortgage agreement. Gumapac said he was expecting Deutsche Bank to pursue a claim, which would have uncovered the defect and, under terms of the insurance policy, triggered the insurer to pay the debt.

But lenders generally have considered such kingdom-related title claims frivolous.

In Gumapac’s case, Deutsche Bank didn’t pursue an insurance claim and proceeded with the foreclosure, he said. In December 2011 the bank filed a so-called ejectment complaint seeking his eviction. Two years later Gumapac was forced out.

An attorney for Deutsche Bank didn’t respond to a request for comment.

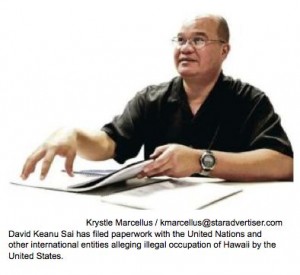

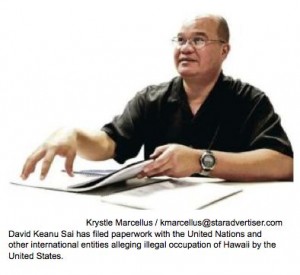

One of the more interesting aspects of the rise in the kingdom-related foreclosure defense is a political scientist who is a key advocate of it.

David Keanu Sai, who has a master’s degree in international relations and a doctorate in political science from the University of Hawaii, serves as a consultant to Gumapac’s company and to Kaiama.

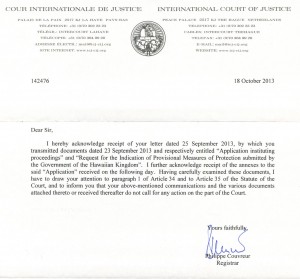

Sai also has taken his arguments to various international organizations, including the president’s office of the United Nations General Assembly, the International Criminal Court and the International Committee of the Red Cross in Switzerland, where he was joined last month by Kaiama. They are pursuing cases alleging war crimes and the illegal occupation of the islands by the United States.

Sai made headlines in the mid-1990s as co-founder of Perfect Title Co., which used kingdom law to claim existing land titles in Hawaii were invalid — essentially the same arguments being made today in the foreclosure cases. The company riled the real estate industry because it filed reports at the Bureau of Conveyances casting clouds on titles.

Perfect Title shut down in 1997 after the state seized its records as part of an investigation. Sai eventually was convicted of first-degree attempted theft, a felony, for helping a couple try to reclaim an Aiea home they lost through foreclosure. He received five years’ probation.

Though Sai makes the same basic points today that he did in his Perfect Title days, his argument is more refined now, benefiting from the advanced degrees he obtained since then. Even some of his harshest critics say he is more persuasive.

Sai said it’s not unexpected that Hawaii courts refuse to validate the kingdom argument, saying that one judge even acknowledged he would be committing political suicide if he did so.

But the historical evidence is overwhelming and has yet to be refuted, Sai added, and he expects justice eventually to prevail in the international arena, where international law applies.

“We have to be patient but patience is not a weakness,” Sai said.

Asked about Sai’s case, a spokeswoman for the U.N. president’s office said in an email to the Star-Advertiser that a sovereign matter is beyond the purview of the office.

The International Criminal Court did not respond to Star-Advertiser emails seeking comment.

Rosen, the lender attorney, is upset that the state and the courts have done nothing to prevent the discredited kingdom arguments from continuing to be made, giving homeowners false hope that their properties might be saved. People who charge homeowners to provide such a defense should be prosecuted or sanctioned, he said.

“How are they allowed to continue doing this?” Rosen asked. “It’s nothing more than a fraud.”