The Preliminary Report on the Legal Status of Land Titles throughout the Realm of July 16, 2020, by the Royal Commission of Inquiry, is a comprehensive report as to why the majority of land titles today throughout Hawai‘i are defective. This includes properties claimed to be owned by billionaires such as Mark Zuckerberg’s claim to property on the island of Kaua‘i, and Larry Ellison’s claim to 98% of the island of Lana‘i. The Royal Commission of Inquiry also published a Supplemental Report on Title Insurance on October 20, 2020.

All titles to real estate throughout the Hawaiian Kingdom are subject to Hawaiian laws despite the unlawful overthrow of its government by the United States in 1893. As such, all titles that have since been alleged to have been conveyed after January 17, 1893, are void ab initio due to forged certificates of acknowledgment by individuals impersonating public officers. This includes all purported conveyances of Government or Crown lands after January 17, 1893, and any judicial proceedings regarding titles to land.

Hawaiian law, however, would have recognized these acts of the insurgents as being valid if Queen Lili‘uokalani was restored to office. The agreed upon conditions of restoration between the United States and the Hawaiian Kingdom provided, “a general amnesty to those concerned in setting up the provisional government and a recognition of all its bona fide acts and obligations.” Regarding the “bona fide acts and obligations,” the Queen stated in her letter dated December 18, 1893, to the U.S. Minister Albert Willis, who was negotiating on behalf of President Cleveland, “I further solemnly pledge myself and my Government, if restored, to assume all the obligations created by the Provisional Government, in the proper course of administration, including all expenditures for military or police services, it being my purpose, if restored, to assume the Government precisely as it existed on the day when it was unlawfully overthrown.”

By this agreement, the United States acknowledged the acts done by the insurgency were not “bona fide” until after the Queen was restored. The Queen was not restored and, therefore, the insurgency continued to unlawfully impersonate public officers of the Hawaiian Kingdom in the chain of title. These defects in title are covered risks in the owner’s and lender’s title insurance policies as:

- forgery, fraud, undue influence, duress, incompetency, incapacity, or impersonation;

- failure of any person or Entity to have authorized a transfer or conveyance;

- a document affecting Title not properly created, executed, witnessed, sealed, acknowledged, notarized, or delivered;

- a document executed under a falsified, expired, or otherwise invalid power of attorney;

- a document not properly filed, recorded, or indexed in the Public Records including failure to perform those acts by electronic means authorized by law;

- a defective judicial or administrative proceeding.

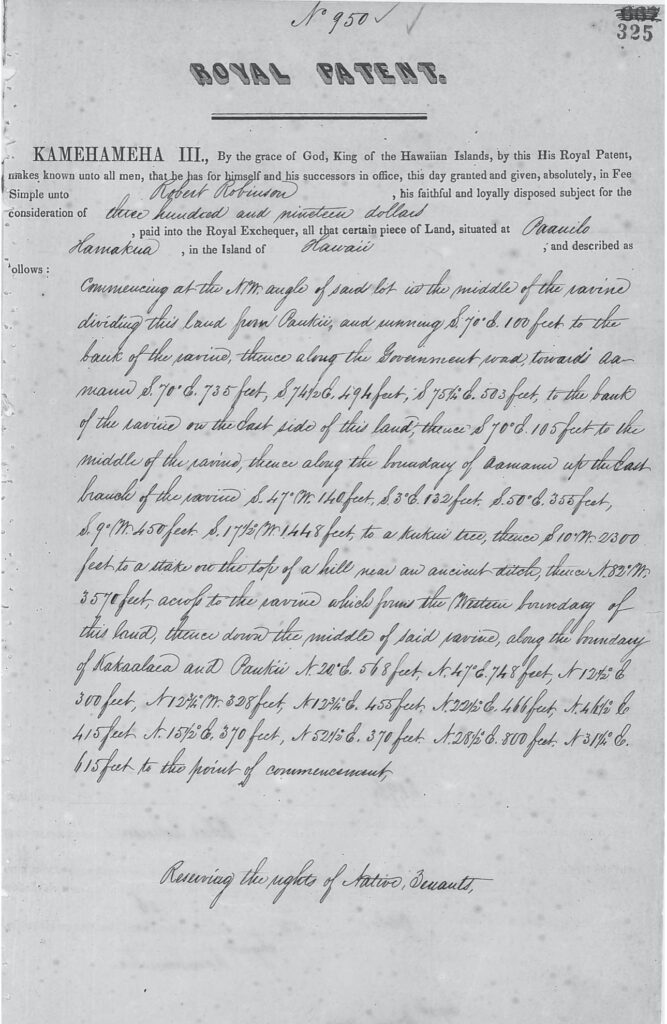

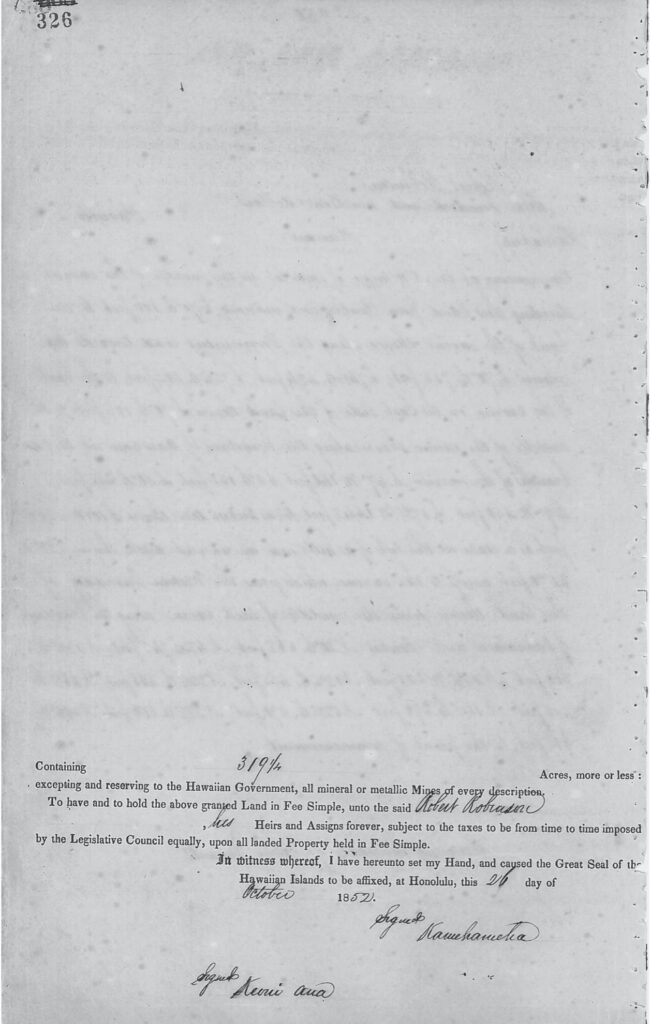

Here’s an example of a “bona fide” Royal Patent issued on October 26, 1852.

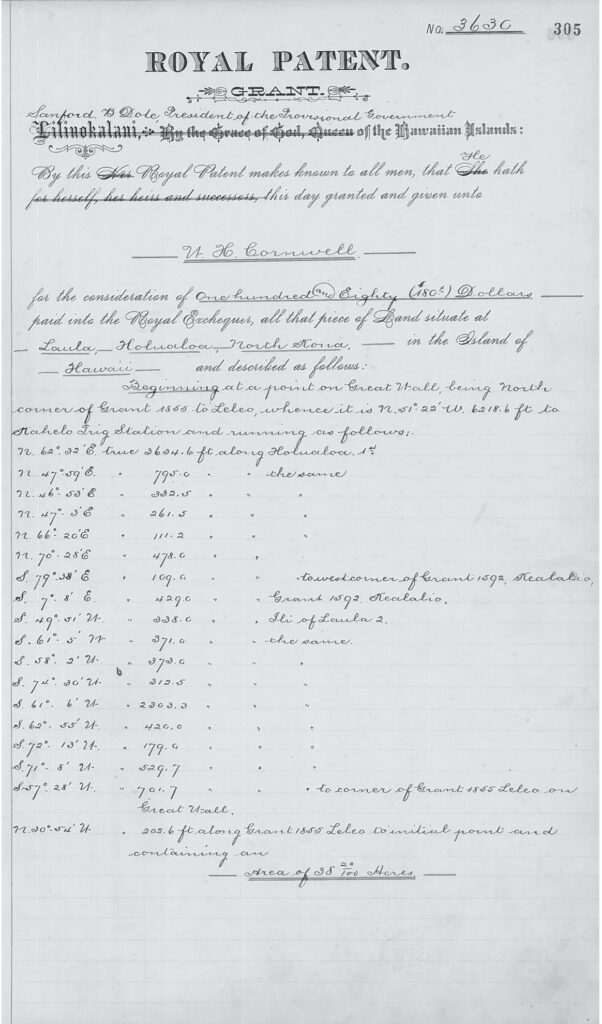

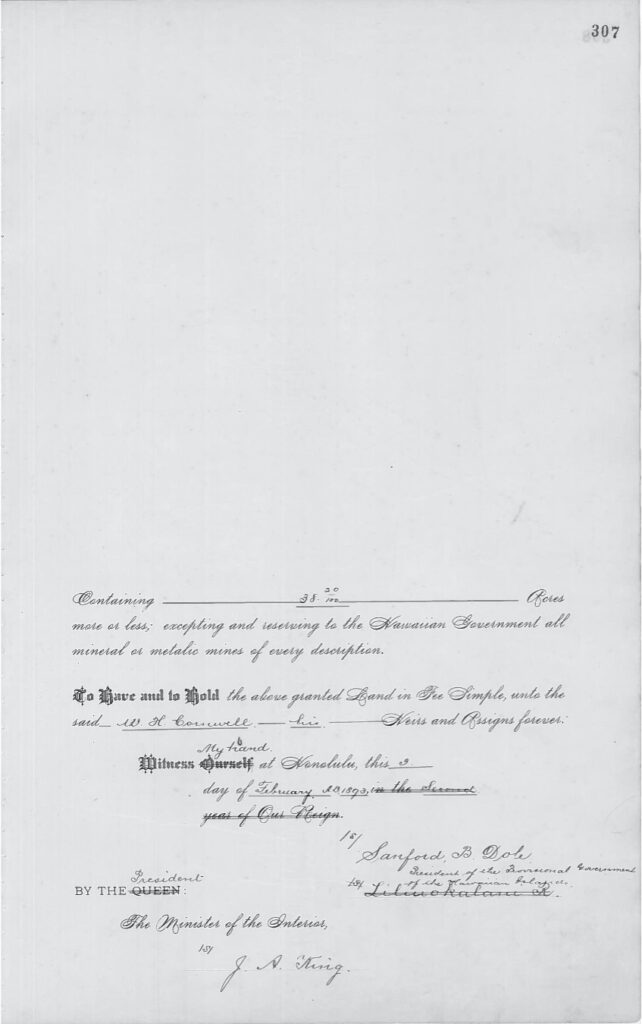

Here is an example of a “forged” Royal Patent issued just one month after the overthrow of the Hawaiian government by the United States dated February 3, 1893. This is an example of what President Cleveland sought to remedy as a “bona fide” act by the insurgents in his agreement of restoration with Queen Lili‘uokalani.

Any property today that derives from this forged Royal Patent is void, but the loss could be covered by an owner’s policy of title insurance. Hill, Steindorff and Widener, in their “Recent Developments in Title Insurance Law,” reported that in 2012, a California Federal District Court, in Gumapac v. Deutsche Bank National Trust, found that “a title report revealed a defect of title by virtue of an executive agreement between President Grover Cleveland and Queen Lili‘uokalani of the Hawaiian Kingdom that rendered any notary actions unlawful. Thus, the deed of conveyance to the homeowners was nullified.” In Hawai‘i, claimants under both an owner’s or lender’s title insurance policy have a duty to immediately notify their insurer of any title defects that affect title to the property or the mortgage that secures the repayment of a loan.

During this time of high prices at the gas pump added on to the high cost of living in the Hawaiian Islands, watching how you spend your money is critical to surviving during this inflation crisis brought upon the residents of Hawai‘i by the United States prolonged occupation of the Hawaiian Kingdom since 1893. But there is some monetary light that many people in Hawai‘i can take advantage of, which is filing a claim with their title insurance company under an owner’s policy, and notifying your bank or lender to file a claim so that your debt owed to the lender is paid off.

When individuals want to borrow money from a bank or lender, they are told by the lender to first go to an escrow company to purchase a lender’s title insurance policy in the amount to be borrowed. Prior to the issuing of a title insurance policy, the escrow company does a title search on the property that the borrower intends to use as a security instrument, also called a mortgage, to ensure the repayment of the loan. A title insurance company that works with the escrow company will then insure the accuracy of the title search. Only when the borrower purchases the title insurance policy to protect the lender from any title defect that affects the mortgaged debt is when escrow comes to a close.

There is another type of title insurance policy that is issued by the escrow company and that is an owner’s policy that protects the owner and not the lender. An owner’s policy is normally purchased when an individual borrows money for the first time and has to go to an escrow company. Many people don’t even know that they may have purchased an owner’s policy unless they look at their closing papers from escrow. Unlike a lender’s policy that covers the debt owed to the lender, an owner’s policy covers the owner’s loss, which is the appraised value of the property at the time the policy is taken out.

Most people are unaware as to what title insurance is and how it works. Typical insurance policies, such as car insurance or flood insurance, insure against a future cause of damage, that may or may not occur. Title insurance, on the other hand, insures against a past cause of damage called defects in the chain of title that affect ownership of real property. According to Burke’s Law of Title Insurance, title insurance is an agreement to indemnify the insured for losses incurred “by either on-record and off-record defects that are found in the title or interest in an insured property to have existed on the date on which the policy is issued.” And Black’s Law Dictionary defines title insurance as a “policy issued by a title company after searching the title…and insuring the accuracy of its search against claims of title defects.” As the Florida Court of Appeals, in McDaniel v. Lawyers Title Guar. Fund, stated, “One of the reasonable expectations of a policyholder who purchases title insurance is to be protected against defects in his title which appear of record.”

Title insurance is a one-time paid premium agreement under both an owner’s policy, that protects the interests of the owner of the property, and a lender’s policy, that protects the lender’s interest—the debt owed—in the mortgaged lien on the property. The owner’s policy does not exceed the amount of coverage on the policy. The lender’s policy coverage reduces as the debt is being paid by the borrower, which will eventually expire once the final payment of the loan is made. Burke explains that coverage under an owner’s policy, however, “lasts for as long as the insured has some liability for title defect, whether as the present owner or possessor, or as a vendor [grantor] and warrantor of the state of the title upon some later sale. There is no such thing as term title insurance. Its policy might, potentially, last forever.” A grantor’s covenant is explicitly stated in its warranty deed where it states, “and that the Grantor will WARRANT AND DEFEND the same unto the Grantee against the lawful claims and demands of all persons.”

Being that title insurance is an indemnity agreement, Burke states that the insurer can also act as a surety, which “is a person agreeing to be answerable for the actions of another.” According to Burke, when there is a breach of covenant and warranty of title by a grantor, the “title insurer might agree to remedy a breach of the covenant for further assurances by bringing the litigation required to cure a title, instead of letting the [grantor] do it.” The right to remedy, as a surety, is provided under Condition no. 5 of both the owner and lender policies that states the insurer “shall have the right, in addition to the options contained in Section 7 of these Conditions, at its own cost, to institute and prosecute any action or proceeding or to any other act that in its opinion may be necessary or desirable to establish the Title, as insured, or to prevent or reduce loss or damage to the Insured.” According to Hill, Steindorff and Widener, an Illinois Appellate Court concluded “that although the title company did not have an ownership interest in the property, the company had issued a title insurance policy and could have redeemed the taxes on the subject property on behalf of the prior owner, to whom it had issued a title policy.”

When the title insurance company is given the evidence of proof of loss of title in a claim letter by the insured, the company has thirty-days to either initiate proceedings to remedy the defect of the title or make a payment to the insured covered in the insurance policy. According to the federal court in Davis v. Stewart Title Guaranty Co., “In law, a title is either good or bad.” The Missouri Supreme Court, in Kent & Obear v. Allen, stated, “the validity of the title arising, the question must be determined whether it is good or bad. We cannot object to the title of the respondent that it is doubtful or unmarketable.” The Davis court also concluded that the “liability of the insurer was definitely fixed under the terms of the policy,” to either remedy the defect or the “payment of loss was due, under the policy, ‘within 30 days thereafter.’”

To determine “on-record defects in title,” a title insurer relies on a competent title search. According to Baker, Miceli, Sirmans, and Turnbull’s article, “Optimal Title Search,” in the Journal of Legal Studies, “Some states have no set length but instead require that the entire title history of a parcel of land be searched back to the state’s date of patent,” which include Alaska, Arizona, California, Florida, Idaho, Kansas, Montana, Nebraska, Nevada, North and South Dakota, Oregon, Texas and Washington. At the highest number of years for a title search are Colorado, Kansas, Montana, Nebraska, North and South Dakota, and Wyoming at 187 years. At the low end of a 30-year search are New Mexico, Oklahoma and Tennessee. In a study of optimal title searches, Hawai‘i, Illinois and Indiana were excluded from the analysis because they provided “indeterminate search lengths.”

In one particular preliminary report by Title Guaranty of Hawai‘i, its title search only went back one conveyance. This lack of a full title search by Title Guaranty, who serves as an agent for title insurance companies, back to the original patent, called Royal Patents, only amplifies the purpose of title insurance as an indemnity agreement. It is not a guaranty of the state of the title. According to the Pennsylvania court, in Hicks v. Saboe, “The purpose of title insurance is to protect the insured…from loss arising from defects in the title which he acquires.” The federal court, in Omega Healthcare Investors, Inc. v. First Am. Title Ins. Co., stated, “Because title insurance [is] a contract of indemnity, the insurer does not guarantee the state of the title, but agrees to pay for any loss resulting from a defective title.” The Maryland Appeals Court, in Stewart Title Guar. Co. v. West, explained that a title insurer does not have a duty to advise “on the state of title to the property, but to insure against…loss resulting from any defects.” Therefore, “the title insurer does not ‘guarantee’ the status of the grantor’s title. As an indemnity agreement, the insurer agrees to reimburse the insured for loss or damage sustained as a result of title problems, as long as the coverage for the damages incurred is not excluded from the policy.”

Since 1994, the State of Hawai‘i courts have applied, whenever the issue of the Hawaiian Kingdom’s continued existence as a State arose in court proceedings, the State of Hawai‘i v. Lorenzo case at the Intermediate Court of Appeals (ICA), which has come to be known as the Lorenzo doctrine in the federal courts. For 28 years, both the State of Hawai‘i courts and the federal courts have been applying the Lorenzo doctrine wrong. Under international law, which the ICA acknowledged may affect its rationale of placing the burden on the defendant to prove the Hawaiian Kingdom “exists as a State,” shifts the burden on the party opposing the continued existence of the Hawaiian Kingdom that it “does not exist as a State.” In international arbitration proceedings at the Permanent Court of Arbitration from 1999-2001, in Larsen v. Hawaiian Kingdom, PCA case no. 1999-01, the PCA acknowledged the Hawaiian Kingdom continues to exist as a State and the Council of Regency as its government. Because the Hawaiian Kingdom still exists, so do the laws that apply to real property.

In a denial letter to a title insurance claimant, Michael J. Moss, Senior Claims Counsel for Chicago Title Insurance Company, specifically referenced the Lorenzo doctrine applied in two State of Hawai‘i court cases and one federal court case as a basis to decline the insurance claim under an owner’s title insurance policy in the amount of $178,000.00. Moss stated:

The Hawaiian Courts have consistently found that the Kingdom of Hawai‘i is no longer recognized as a sovereign state by either the federal government or by the State of Hawai‘i. See State v. Lorenzo, 77 Hawai‘i 219, 221, 883 P.2d 641, 643 (Haw.App.1994); accord State v. French, 77 Hawai‘i 222, 228, 883 P.2d 644, 649 (Haw.App.1994); Baker v. Stehua, CIV 09-00615 ACK-BMK, 2010 WL 3528987 (D. Haw. Sept. 8, 2010).

Like the courts of the State of Hawai‘i and the federal courts, the Senior Claims Counsel incorrectly applied the Lorenzo doctrine, which should have been in favor of the title insurance claimant. The title insurance claim was that the “Owner’s deed was not lawfully executed according to Hawaiian Kingdom law [because] the notaries public and the Bureau of Conveyance weren’t part of the Hawaii[an] Kingdom, that the documents in [the claimant’s] chain of title were not lawfully executed.” In other words, the Lorenzo doctrine, when applying international law correctly, would compel the title insurance company to pay the claimant his $178,000.00 covered under the owner’s title insurance policy he had purchased to protect him in case there was a defect in the title.

To find out if you have an owner’s policy check your closing papers from escrow to see if you purchased a policy. Or you can call your escrow company or companies that you went to in the past. If you have a mortgage you did purchase a title insurance policy to protect the lender. To file a claim under your owner’s policy download this MSWord document and fill in the necessary information after you have your owner’s policy in hand. To send a letter to your lender to file an insurance claim under the lender’s policy you purchased download this MSWord document and fill in the necessary information.

Submitting an insurance claim is a private matter that is subject to the terms of your contract or policy. Under the terms of the policy you and the lender are obligated to notify the insurance company if you have been made aware that there are defects in your title. It is suggested that you carefully read over your title insurance policy before you send your claim to the insurance company by certified mail. The lender, not the borrower, has a copy of the lender’s policy that was purchased by the borrower. Once the claim, whether by the owner or the lender, is received by the insurance company you will receive a letter acknowledging your claim and assigning it a claim number. This letter by the insurance company will begin the thirty-day window to either remedy the defect in the title or pay the amount covered under the policy.

Aloha and thank you for sharing this message!

How would I find out if the property my townhome/apartment sits on is Government and ir Crown Lands in Ewa?

Does this also cover those on DHHLs?

Title search.

Movie, not sure why you are asking about what type of land your property sits on because all land titles conveyed since January 17,1893 are defective. See the first and second sentences of the second paragraph in this article. Hope this helps.

Aloha Kekia! Mahalo for that unfirmatiin and yes I read this whole article and I’m sure I am not the only one with questions.

Kekoa, are you with the Council of Regency and work along side Dr. Sai?

Movie, the Council of Regency are professionals and on a whole different level than me. The preliminary report and supplemental reports are also a must read. This blog has a lot of information in the articles and links. I’m sure you will find the majority of the answers to your questions here. Keep researching and asking questions. The answers will come.

Yes it does. Try check out the Papakilohoku database. OHA has one too but not sure what it’s called. Both are digital archives of actual records in the Bureau of Conveyance.

This in-depth article about Lanai came out just a couple weeks before you posted this: https://www.bloomberg.com/graphics/2022-oracle-larry-ellison-lanai-hawaii-plans-tourism/

Interesting, I notice however there are defects in almost everything from deeds to legal processes. Even individuals, people who claim to be Hawaiians but haven’t renounced their US citizenship nor repatriated.

Lopaka, here we go again trying to use this forum to push your expatriation and repatriation BS process and agenda. This blog nor the Council of Regency NEVER said that in order to be recognized as a Hawaiian Subject an individual must expatriate and repatriate. I guess you have got to be schooled like the others that tried it on this blog.

Humanitarian Law in Armed Conflict, which includes occupations. Chapter 5 Protection of the civilian population. Section 2. Legal Status of the Population

541 “The legal status of the population shall not be infringed by any agreement concluded between the authorities of the occupied territories and the occupying power, nor by any annexation by the latter of the whole or part of the occupied territory. (Art. 47 GC IV).

1. “According to Article 47 GC IV, the rights of the inhabitants of occupied territories shall not be curtailed by any agreement or other arrangement between the occupying power on one hand and the authorities of the occupied territory on the other. This provision is intended to prevent local authorities, under pressure from the occupying power, from making concessions to the detriment of the inhabitants of the territory which would impair their legal status. Any such agreement is void.”

2.”In particular, the annexation of foreign territory by the occupying power is prohibited by international law (see commentary to section 525). Such annexation would be invalid even if ‘concessions’ in this respect were offered to the local authorities.”

542 ” Protected persons cannot abrogate their rights under the Fourth Geneva Convention (Art. 8).

“This principle applies to the entirety of the international humanitarian law. In all circumstances it is prohibited for the inhabitants of an occupied territory to renounce their rights under GC IV. Whether on their own initiative or as a result of coercion, such a renunciation is null and void. This is to prevent the occupying authorities, acting from a position of strength, from exploiting the weak position of the subject population and revoke, apparently legally, the protection guaranteed by international law.”

The agenda of the Council is the application of Geneva and Hague to a neutral territory in order to resolve the non-compliance to a treaty to restore the Queen. This is no different then Kamehameha bringing Ku while destroying all Kane temples to establish his lineage…have we learned anything at all from our history!

And btw I served under Humanitarian law in Iraq & Afghanistan and the GC and HC didn’t work then (check the Wikileaks record) and it doesn’t now in Ukraine…but the Council’s reach is plain and simple which truly is remarkable. Still you need however to understand that you as a US citizen perpetuates the very fraud that upholds the very entities and US public trust that you claim to be committing war crimes against yourself.

Ku is not worshipped on O’ahu! This is the land of Kane…it is foolish for you to point the finger yet perpetuate the fraud so in the words of our Queen…

“A hiki mai ke aloha, a’e pono mai ana, ke kaheka kai kapu a Kane, ka mole ke a’a o ka ‘aina.” – Liliu’okalani

Lopaka, you always deflect from the law and the truth with nonsense. Let me prove it to you since you brought up Iraq and Afghanistan. After Iraq invaded Kuwait, Iraq passed a law annexing Kuwait just like the U.S. passed a law annexing Hawaii. Did the Kuwaitis have to expatriate from Iraq and repatriate to Kuwait in order for them to regain Kuwaiti nationality? Of course not! But according to your stupid logic they would have to do it because they were annexed during the occupation by Iraq. Side note. I don’t think you can criticize me of committing war crimes against myself using your stupid logic. The only one that might be a war criminal would be you since you admitted being a member of the U.S. occupying force in Afghanistan when the U.S. invaded Afghanistan. By the way you guys failed in Afghanistan.

Aloha e Lopaka,

I’ve noticed your comments on renouncing US citizenship and repatriating to the HK in a few posts now, could you please explain what exactly you mean, particularly I’m wondering who you are repatriating to specifically, meaning who is the HK, what HK governmental entity are you submitting repatriation forms to, what is the process, what is required of an individual seeking to proceed in this process, things of this nature.

Mahalo nui for your time.

‘Ano’ai e Aloha,

I speak on the level of personal responsibility or kuleana, not on any state’s right level as any kind of acting government or as an expert. Simply put, a nation can exist without a government but not vice versa.

DS 4079 is the renunciation form which would need to be turned into the Bureau of Consular Affairs (same agency handles passports) here in the islands. On the form, you can explain how you came to know you were a US citizen and can be honest about it…like “I had to say the pledge of allegiance in school until I was a teenager but never signed up for social security, my parents did before my age of majority or my right to contract could be executed by me.”

Given the Hawaiian Islands/Kingdom is not a signatory of the Hague/public international law, you would then need certification of your public birth certificate with the Secretaries of State for Hawaii and US. Note the country. Apostille needed if repatriating to a country that is a party to the Hague.

Now, one of the primary issues is the lack of protection the acting government or Council can actually provide for Hawaiian nationals as explicated by Lance Larsen vs Hawaiian Kingdom.

Aloha P., Lopaka, who I suspect has been using other names on this blog to avoid answering difficult question or providing documented success has been trolling this blog to promote his own process to recruit followers. Obviously, he does not have his own blog to recruit followers, so he comes here. What Lopaka is not telling you and everyone else is the pain you will suffer once you take the bait, and you will be on the hook alone to fend for yourself. If you thought surviving this occupation was hard, wait until you use his process. Be very careful.

Truly the fear of living as a Hawaiian national, without the benefits of the State and Fed’s is truly what prevents our self determination. However it is just an administrative process to execute your right to self determination. Your civil and political rights are not self executing under the ICCPR per US reservations. You can test it out with a SSN first, try giving your employer or contractor, as a foreign person, a W8 instead a W2. Take the position as a foreign person with the IRS while utilizing a SSN and see what that does?Provide them the treaty provisions that exempt taxation of Hawaiians. Play in the sand box for awhile. Go ahead!

The administrative process provided by the Council or this blog is governed under the same regime that I inform about, the UCC. Signing under protest pursuant to HRS 490-1-308 protects your rights and property. It’s just business, and contracts. You provide notice of your position and demand appropriate remedy. Offset and discharge…but what do you know about money mechanics and double entry bookkeeping!!! My position is simply knowing the system and matrix of codes, US citizens must follow the regulations!!!

As far as using other names, I’ll let the administrator of this site answer that. Surviving this occupation is easy if you follow the regulations and temper your emotions to think clearly. I’m not clouded by emotion about what happened more than 100 years ago to my ancestors cause I accepted responsibility for the path that brought me here…the struggle is real cause people don’t follow the regulations.

Not to avoid answering difficult questions, nor to troll but simply to share and maintain my presence here on this forum because the administrator has blocked my other accounts. If you want to know about me, then ask Keanu and Dexter!

Kekoa I think you do an excellent job I only read your mama’s honest and to the point

Where the rubber meets the road…the commercial transactions regarding warranty deeds of the usurper comes to a slow end!!! Alongside probate rule 73 which can get you determined as heirs to your ancestral lands, it only gets better from here as the legal mobilization of the Hawaiian state is in progress…thanks Kumu!!! #RighteousConcepts #ImuaEa #LaHoihoiEa

The most important point about this article is that it provides the rationale and a blueprint for filing a claim.

My logic stems from 5 USC 71-78 transferred to 48 USC 1501-1508. The reason why the struggle is real is because our ancestors made it so! Either that or end up stateless and unable to earn a living. The power is in the people!!!

Yes, claims regarding transactions governed under the UCC which you can sign under protest given the obvious defects we know exists!!! That’s to say nothing of the so called loan…just saying!!!

Thank you for the enlightenment Aloha

Do you know of anyone successfully filing a title insurance claim for a Hawaii property, based on the title being defective?

I was wondering the same thing.

Mahalo for all the hard work & resources! I’m in battle now & sent out my Title Defect claim letters out. Fingers crossed since we all know they are “agents” of the occupier & most nokea! Since I was terminated for not consenting to those fraud mandates, I look foward to holding HIDOE/gov accountable– next. WWG1WGA! <3

Has any title insurance company paid out these types of claims yet? I’m thinking probably not.

Have been battling the cabal’s “justice” system thus far unsuccessfully. Followed the Title Defect letter protocols, also included loan officers via email too. So far, all efforts DENIED by their mafia banking & ‘justice’ syndicate. Got a great tip to FILE BANKRUPTCY BEFORE they illegally sell your hale to give you “protection” (albeit you must resume loan payments + 1/60th). Seems SO WRONG to keep participating in their FRAUD systems, ugh. Hoping HK case vs. Joe Biden et al is soon victorious! TRUTH WILL WIN (((eventually)))! Keep your HOPE! <3

I did send in to the title company for defective title they responded said within 30 days they will contact now its over the 30 days with no response…what to do now?